Are Books Taxable In Massachusetts . the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. Whether you run a quaint. While the massachusetts sales tax of 6.25%. this is your quick guide to understanding the twists and turns of the massachusetts sales tax regulations. what purchases are exempt from the massachusetts sales tax? this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional.

from cehdbwca.blob.core.windows.net

what purchases are exempt from the massachusetts sales tax? this is your quick guide to understanding the twists and turns of the massachusetts sales tax regulations. this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as. While the massachusetts sales tax of 6.25%. Whether you run a quaint. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable.

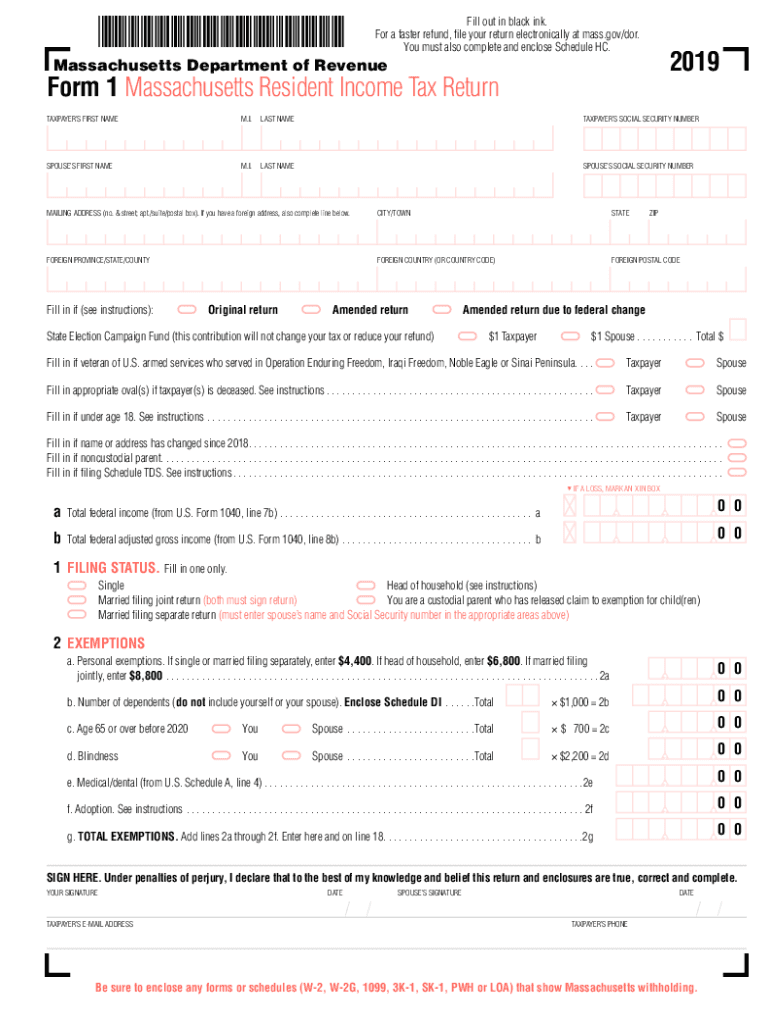

Ma Tax Booklet at Betty Stoltenberg blog

Are Books Taxable In Massachusetts Whether you run a quaint. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. While the massachusetts sales tax of 6.25%. Whether you run a quaint. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales. what purchases are exempt from the massachusetts sales tax? the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. this is your quick guide to understanding the twists and turns of the massachusetts sales tax regulations.

From taxindiaupdates.in

Tax Planning Books Are Books Taxable In Massachusetts what purchases are exempt from the massachusetts sales tax? although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. Whether you run a quaint. the taxability of various transactions (like services. Are Books Taxable In Massachusetts.

From www.chegg.com

Solved Grand Corporation reported pretax book of Are Books Taxable In Massachusetts Whether you run a quaint. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. this is your quick guide to understanding the twists and turns of the massachusetts sales tax regulations. this guide breaks down everything you need to know about mass’ sales tax, from determining the right. Are Books Taxable In Massachusetts.

From flyingoffthebookshelf.com

30 Books Set in + About Massachusetts Flying Off The Bookshelf Are Books Taxable In Massachusetts each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. this. Are Books Taxable In Massachusetts.

From www.taxuni.com

Massachusetts Tax Calculator 2023 2024 Are Books Taxable In Massachusetts the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as.. Are Books Taxable In Massachusetts.

From cehdbwca.blob.core.windows.net

Ma Tax Booklet at Betty Stoltenberg blog Are Books Taxable In Massachusetts Whether you run a quaint. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. what purchases are exempt from the massachusetts sales tax? the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as. each state’s. Are Books Taxable In Massachusetts.

From itep.org

Massachusetts Who Pays? 6th Edition ITEP Are Books Taxable In Massachusetts Whether you run a quaint. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. the taxability of various transactions (like services and shipping) can vary from state to. Are Books Taxable In Massachusetts.

From masierratax.com

Tips to reduce Taxable for Small Businesses Ma Sierra Tax Are Books Taxable In Massachusetts Whether you run a quaint. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. this guide breaks down everything you need to know about mass’ sales tax, from determining. Are Books Taxable In Massachusetts.

From www.abebooks.co.uk

An Original 1867 Tax Receipt for Alexander Graves Newburyport Are Books Taxable In Massachusetts this is your quick guide to understanding the twists and turns of the massachusetts sales tax regulations. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. Whether you run a quaint. the taxability of various transactions (like services and shipping) can vary from state to state, as do policies. Are Books Taxable In Massachusetts.

From anatolawamy.pages.dev

Massachusetts Tax Calculator 2024 Alix Bernadine Are Books Taxable In Massachusetts this is your quick guide to understanding the twists and turns of the massachusetts sales tax regulations. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as.. Are Books Taxable In Massachusetts.

From virtualestateattorney.com

The Massachusetts Estate Tax Explained Timothy J. Erasmi, Esq Are Books Taxable In Massachusetts Whether you run a quaint. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. While the massachusetts sales tax of 6.25%. this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales. what purchases are exempt from the massachusetts. Are Books Taxable In Massachusetts.

From www.taxuni.com

Massachusetts Property Tax 2023 2024 Are Books Taxable In Massachusetts this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. what purchases are exempt from the massachusetts sales tax? While the massachusetts sales tax of 6.25%. although massachusetts. Are Books Taxable In Massachusetts.

From exozoerfs.blob.core.windows.net

Are Books Taxable In Pa at Greg Short blog Are Books Taxable In Massachusetts this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales. Whether you run a quaint. While the massachusetts sales tax of 6.25%. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. although massachusetts still levies a 6.25 percent. Are Books Taxable In Massachusetts.

From www.irstaxapp.com

Massachusetts Tax Rates 2022 & 2021 Internal Revenue Code Simplified 2022 Are Books Taxable In Massachusetts the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as. the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales.. Are Books Taxable In Massachusetts.

From exozrkgbh.blob.core.windows.net

Examples Of Book To Tax Differences at Marie Merritt blog Are Books Taxable In Massachusetts While the massachusetts sales tax of 6.25%. Whether you run a quaint. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is considered taxable. the massachusetts state sales tax is 6.25%. Are Books Taxable In Massachusetts.

From exozrkgbh.blob.core.windows.net

Examples Of Book To Tax Differences at Marie Merritt blog Are Books Taxable In Massachusetts While the massachusetts sales tax of 6.25%. Whether you run a quaint. what purchases are exempt from the massachusetts sales tax? this guide breaks down everything you need to know about mass’ sales tax, from determining the right sales. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property” is. Are Books Taxable In Massachusetts.

From www.accountooze.com

What is the difference between book vs taxable Are Books Taxable In Massachusetts the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as. what purchases are exempt from the massachusetts sales tax? this is your quick guide to understanding the twists and turns of the massachusetts sales tax regulations. the massachusetts state sales tax is 6.25% on. Are Books Taxable In Massachusetts.

From crea-stone.com

Massachusetts Tax Calculator Créa Stone Are Books Taxable In Massachusetts although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. what purchases are exempt from the massachusetts sales tax? the massachusetts state sales tax is 6.25% on most tangible goods and select services, with no additional. Whether you run a quaint. While the massachusetts sales tax of 6.25%. . Are Books Taxable In Massachusetts.

From www.chegg.com

ABC, Inc. 2020 Book/Tax Reconciliation Worksheet Are Books Taxable In Massachusetts the taxability of various transactions (like services and shipping) can vary from state to state, as do policies on subjects such as. although massachusetts still levies a 6.25 percent sales tax on most tangible items, there are quite a few. each state’s laws regarding sales tax are a little different, but in general any “tangible personal property”. Are Books Taxable In Massachusetts.